Unfolding the new design of Salt Edge client dashboard

Design brainstorming sessions, UX/UI research, hours of prototyping, and deep analysis of clients’ feedback have kept us busy lately and resulted in a newly improved client dashboard. Considering clients’ suggestions, we’ve shaped a friction-less dashboard to show critical and pertinent data at-a-glance. Our top priority was not only to create a functional interface for users, but also to upgrade and add features for building a more developer-friendly environment. Due to our technical background, we know the importance of an insightful dashboard for successful product development.

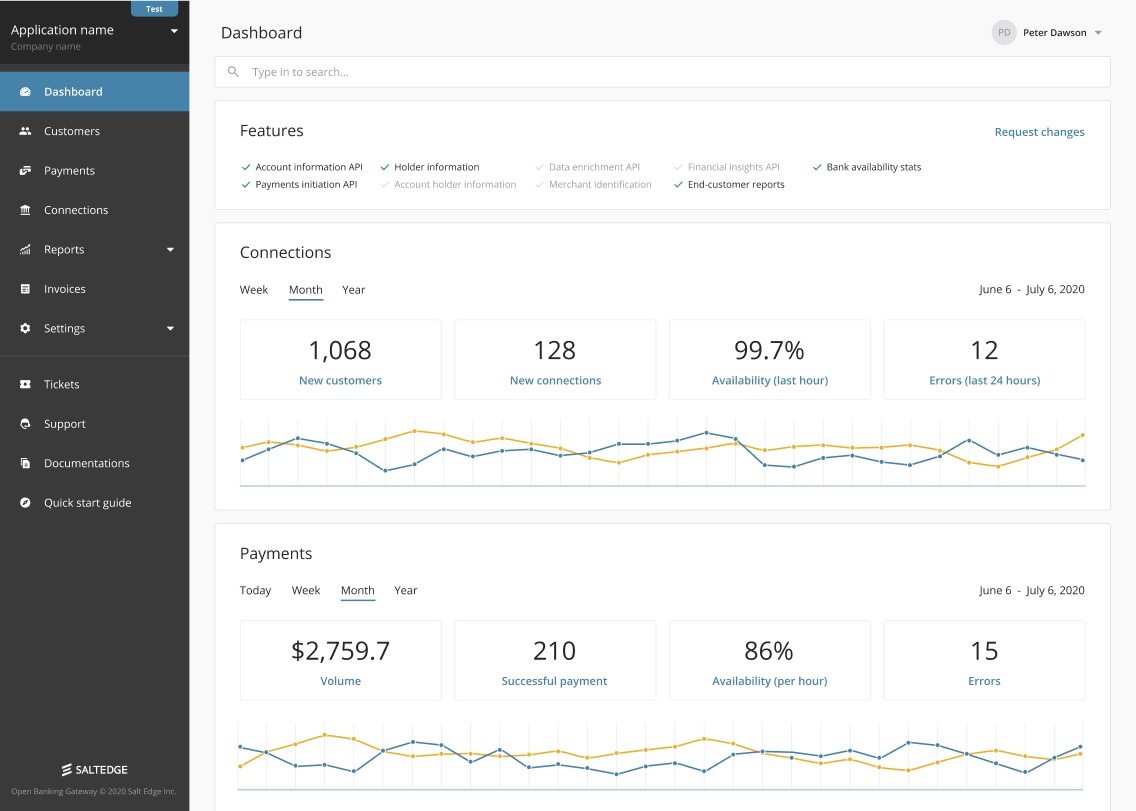

Improved overview for AIS and PIS

Dashboard improvement ramble starts with easy-to-read widgets that allow clients to see users’ statistics overview, discovering how many connections and payments were made in a span of a day, week, month, or even year. Improved visual representation helps clients to instantly draw a holistic picture of their business progress, to analyse their open banking development and adjust the strategy if necessary.

Another important update is that now companies see all available and newly added Salt Edge features and can request access to interested ones directly from the dashboard.

Easier navigation between environments (application/team/company)

To make the navigation even more intuitive and convenient, we have made a logic division by environments: team, application, and company. Clients can configure and customise each section’s data by adding descriptions and important details.

- In the team section, clients can manage roles and permissions of their teammates. Adjusted team section management enables clients to maintain a high level of security.

- The application being the clients’ actual app that is connected and communicates with bank channels.

- The company section includes the client’s legal information for simplifying onboarding with banks, invoicing, and more.

Simplified request for connection to banks

We have seemingly simplified the process of companies’ onboarding with banks. Now clients can monitor and manage bank connections in an easier and faster way. They can see all the banks supported by Salt Edge and their channels’ availability. Displayed availability of a banks’ API helps to decide whether a certain bank is worth being connected to. This way companies will be able to offer seamless services to end-customers, not disrupting their user journey and thus, loyalty.

The search bar and filtration by supported banks in terms of PSD2 and Open Banking allow clients to request connection to any bank directly from the dashboard.

Dynamic registration

To ease and speed-up the process of onboarding with groups of banks, we have developed a new mechanism – dynamic registration. It was created to save thousands of man-hours and eliminate manual processes and red-tape on clients’ onboarding with EU banks. Salt Edge is the pioneer-provider of this tool on the pan-European market and made it available directly in the dashboard, thus making the onboarding process most handily.

Multiple application switching in one click

Another useful feature added to make clients’ life easier is switching between multiple applications. Now clients can register with a single email for several different Salt Edge services and toggle between applications directly in the dashboard. It permits to manage all applications effortlessly from one screen, without the need to log out.

Coming soon

There is always room for improvement so we are happy to open the veil of our coming soon upgrades. We are adding the possibility for self-service customisation of the Salt Edge connect widget to improve the customer journey. Soon, companies will be able to add their logo and change the colours of the widget used by end-customers to connect their bank accounts to the brand company’s colours. Seeing their familiar company brand makes end-users feel comfortable and safe to proceed with connecting their bank.

Stay tuned, more interesting updates are yet to come!

Ready to get started with Salt Edge’s Open Banking Platform?

Latest Articles

International Women’s Day 2021

International Women's Day 2021 To celebrate International Women's Day 2021, Barclays would like to invite you to join a series of panel discussions to be held virtually on: Monday, 8 March - 8:30am - 9:30 am EST / 1:30pm - 2:30pm GMT Thursday, 11 March - 4:00pm -...

Fintech investment builds on momentum and is set for record year

Fintech is continuing to enjoy popularity with investors who see it as a sector with excellent prospects for sustainable growth. The sector’s rise last year against a backdrop of great uncertainty has continued in 2021, with strong investment volumes gaining momentum....

Singapore Fintech Festival 2019

Singapore FinTech Festival 2019 summary of activities from the Fintech Power 50: Singapore FinTech Festival 2019 has proved another resounding success. Inaugural SFF x SWITCH sees over 60,000 participants from 140 countries; event to return on 9-13 November 2020....