The development of the new Smart Banking app follows Meniga’s and UniCredit’s successful collaboration on the launch of the innovative Mbanking app, in Serbia in 2019.

Prague, 16 April 2020 — We’re delighted to announce our partnership with UniCredit, to launch an enhanced version of the popular Smart Banking app in the Czech Republic!

Utilising Meniga’s innovative technology, Smart Banking has been developed to drive UniCredit’s customer engagement and increase loyalty, with the app acting as an everyday financial adviser for its users.

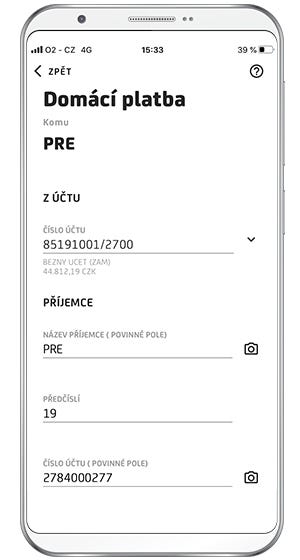

It provides a clear and understandable overview of a user’s income and expenses, as well as access to detailed information about their current accounts, loans, and credit cards. Transactions can also be sorted and categorised based on the individual preference of the user.

Key features of the new app, developed in partnership with Meniga, include:

● Detailed overviews of the user’s account, card, loan and mortgage

● Incoming and outgoing payments summarised through easy-to-read graphs

● Categorisation of all transactions to allow for better budgeting and an overview of spending

The Smart Banking app is free-to-download and available via the AppStore and GooglePlay.

Georg Ludviksson, CEO and co-founder of Meniga comments:

“We are proud to have established a really fantastic partnership with UniCredit and are very pleased to remain part of its product development.

Meniga has worked closely with the UniCredit team to enhance the app’s capabilities and ensure that it is providing the best possible experience for its users.

The result is a really intuitive app which we know will be of great support to existing and new banking customers so that they can better-manage their finances and day-to-day spending.”

Marco Iannaccone, Vice-chairman of UniCredit Bank Czech Republic and Slovakia comments:

“We are strongly committed to developing innovative products and services that deliver tangible benefits to our customers.

We are therefore very proud to team up with Meniga, a leading European FinTech’s digital banking software company, to develop our Smart Banking mobile application.

Thanks to the partnership, we can offer to our clients unique features and support them to become real experts in managing their banking and financial activities.”

Latest Articles

International Women’s Day 2021

International Women's Day 2021 To celebrate International Women's Day 2021, Barclays would like to invite you to join a series of panel discussions to be held virtually on: Monday, 8 March - 8:30am - 9:30 am EST / 1:30pm - 2:30pm GMT Thursday, 11 March - 4:00pm -...

Fintech investment builds on momentum and is set for record year

Fintech is continuing to enjoy popularity with investors who see it as a sector with excellent prospects for sustainable growth. The sector’s rise last year against a backdrop of great uncertainty has continued in 2021, with strong investment volumes gaining momentum....

Singapore Fintech Festival 2019

Singapore FinTech Festival 2019 summary of activities from the Fintech Power 50: Singapore FinTech Festival 2019 has proved another resounding success. Inaugural SFF x SWITCH sees over 60,000 participants from 140 countries; event to return on 9-13 November 2020....