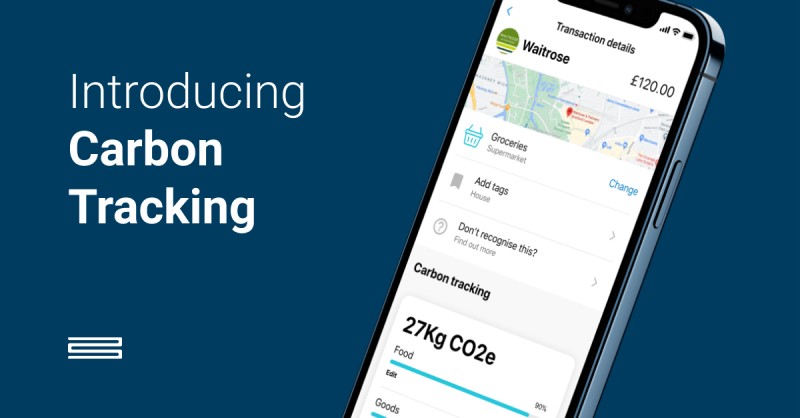

The open banking fintech Bud has signed a deal with the Nordic eco-payments firm Enfuce to bring its “My Carbon Action” product to the UK. The deal will see Bud’s Open Banking and transaction enrichment services combined with Enfuce’s carbon tracking engine to provide UK customers with a clear indication of how their spending impacts their carbon footprint.

Enfuce’s “My Carbon Action” product brings together lifestyle information and a carbon tracking methodology developed by leading climate researcher Dr. Michael Lettenmeier to provide users with a personalised carbon footprint. The partnership with Bud will allow users to add an additional layer of transaction data to produce more personalised scores based on categorised spending.

“Open Banking is quickly maturing into an easy route for banks and financial institutions to deliver innovative solutions through their mobile apps. Our partnership with Enfuce is a clear example of something that, only a couple of years ago, would have been a massive technical undertaking and that can now be integrated in a matter of weeks”, commented Ed Maslaveckas, CEO of Bud.

“We’ve seen an explosion in the number of financial services organisations out there targeted at specific sectors of the population – where people are building entire businesses out of a service that feels personal to its users. Banks have a huge opportunity to offer this kind of personalisation at scale, it’s something we’re looking forward to delivering as we expand our ecosystem of open banking enabled solutions”, Maslaveckas added.

“Our partnership with Bud is a major step to accelerate change for the better on our planet. My Carbon Action had a positive effect on 30% of its users already during the proof of concept for Rabobank, and I’m confident it’ll have a significant role in reducing the CO2 emissions in the UK and the EU”, said Monika Liikamaa, CEO of Enfuce.