Over the past 100 years the financial industry has largely excluded people in retirement. Even today tech entrepreneurs are ignoring financial inclusion for people over 60, who make up the wealthiest part of the financial system, and instead, are developing financial products for younger people. The most valuable and capable client demographic in terms of purchasing power are the citizens of the 7th Continent which is made up of 1 billion people over 60. The global spending power of this demographic is expected to be $15 trillion this year. Who will serve this market? Longevity Banks and FinTech 2.0 services will attract people 60+ who want to optimize their wealthspan.

In the last 10 years investment in the FinTech industry has exceeded $350 billion dollars. During the same period a similar amount of funding was invested in other industries such as AI, healthcare, and aerospace. There have been a number of breakthroughs in these other areas but not in FinTech. The amount of money invested in FinTech has not yielded significant results compared to other domains. FinTech received more investment but accomplished less with it. However, recent advances in the development of practical AI tools are enabling new FinTech solutions.

Progressive governments and businesses understand that whole populations are living much longer than in previous generations and realize that we are going to need institutions that are organized in a different way. For example, traditional banks weren’t designed to serve a large number of clients living a long, long time. Today, banks have a small number of clients who are over 100 and they are outliers. In the next decade that demographic will increase dramatically.

In the next few years, age-friendly FinTech companies and Longevity Banks will develop new financial products designed for clients who are planning to live extra long lives and want to remain high functioning and financially stable throughout. Clients of Longevity Banks will have more time to accumulate wealth, will have a longer investment horizon, and will benefit from compounding. Financial services innovators have an opportunity to enhance the financial lives of a billion people by designing new solutions and adapting existing products and services. New products that provide a comprehensive view of investments, taxes, insurance, and regulation without unneeded complexity will appeal to citizens of the 7th Continent.

The Intersection of Longevity and Finance

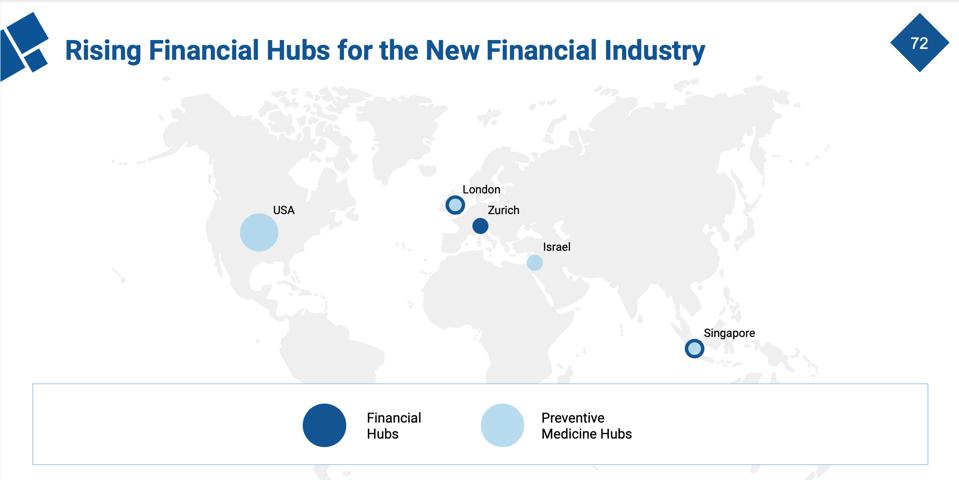

This map shows the location of major preventive medicine and financial hubs. London and Singapore are distinguished as being hubs for both the financial industry and the preventive medicine industry. As such they have extremely strong potential to become global leaders in Longevity and Finance. When these industries intersect, novel financial systems will be developed that will treat Longevity as a dividend and will play an integral role in the Longevity Economy. The most advanced FinTech 2.0 technology adjusted for Longevity is emerging in London and tools for FinTech 2.0 are already in development there.

The Longevity AI Consortium at King’s College London is developing sophisticated methods for translating advanced AI for Longevity solutions including novel applications of life data for insurance companies, pension funds, healthcare companies, and government bodies. This year the Consortium is planning to expand to Switzerland, Israel, Singapore, and the US. Progressive investment banks, pension funds, and insurance companies are developing new business models, and are using AI to improve the quality of the analytics used to formulate them. In the near future, the synergy between innovative AI and wealth management will lead to the creation of new financial institutions optimized for the aging population and age-friendly Longevity Banks will make banking easier and safer for seniors.

Longevity Valley

These developments will result in the emergence of a Longevity Valley with the highest concentration of robust preventive medicine, HealthTech, Longevity FinTech, and AgeTech. The most likely place for the first Longevity Valley is Switzerland because Switzerland is extremely stable in terms of financial, social, and political frameworks. Switzerland was also recently recognized by the United Nations as the most AgeTech friendly country. The Longevity Valley will attract people who prioritize maximizing their healthspan and wealthspan. The first Longevity Bank is also expected to emerge in Switzerland since the pillars needed for the success of such a bank are present there. These pillars include a progressive RegTech environment, sufficient FinTech development, a MedTech ecosystem, and a significant number of individuals 60+ who fit the client profile.

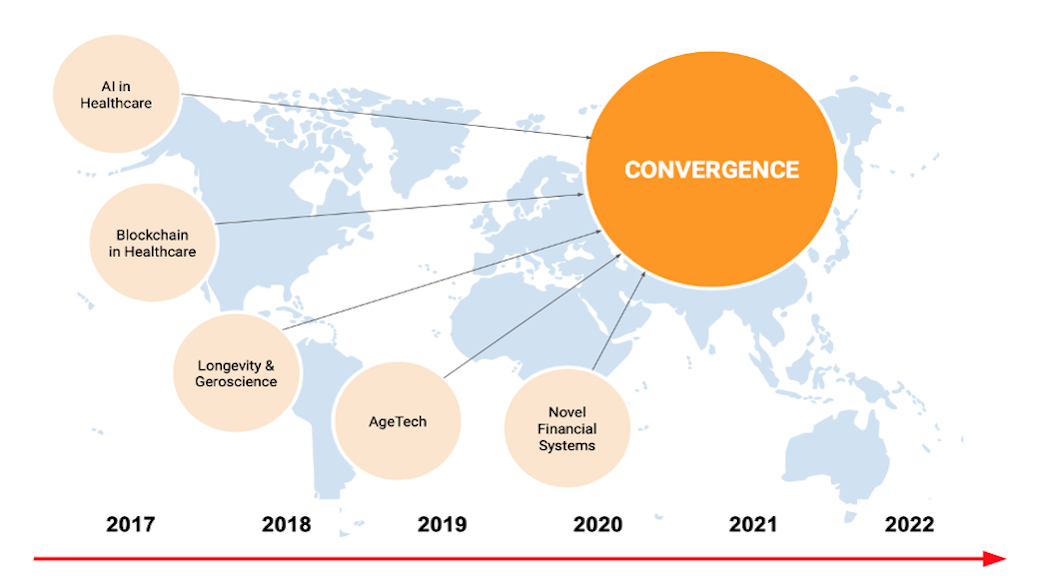

In the near future, FinTech, AI, and data-driven technologies will converge into a single advanced technology. Next generation financial companies will use engineering methods with integrated systems to treat business, finance and technology as a single unit with complementary parts. The resulting FinTech 2.0 will offer unprecedented potential for growth and disruption. Humans have always desired health, wealth, and longevity, but usually had to settle for one or two. For the first time people are planning for a very different future with the possibility of living to 100 and beyond and being healthy and financially stable the whole time.

Margaretta Colangelo is Co-founder and Managing Partner of Deep Knowledge Group, a consortium of commercial and non-profit organizations active on many fronts in the realm of DeepTech and Frontier Technologies including AI, Longevity, FinTech, GovTech, InvestTech, scientific research, investment, and analytics

Twitter –@RealMargaretta

Linked in – Margaretta Colangelo

Latest Articles

International Women’s Day 2021

International Women's Day 2021 To celebrate International Women's Day 2021, Barclays would like to invite you to join a series of panel discussions to be held virtually on: Monday, 8 March - 8:30am - 9:30 am EST / 1:30pm - 2:30pm GMT Thursday, 11 March - 4:00pm -...

Fintech investment builds on momentum and is set for record year

Fintech is continuing to enjoy popularity with investors who see it as a sector with excellent prospects for sustainable growth. The sector’s rise last year against a backdrop of great uncertainty has continued in 2021, with strong investment volumes gaining momentum....

Singapore Fintech Festival 2019

Singapore FinTech Festival 2019 summary of activities from the Fintech Power 50: Singapore FinTech Festival 2019 has proved another resounding success. Inaugural SFF x SWITCH sees over 60,000 participants from 140 countries; event to return on 9-13 November 2020....