The shift to digital seen across the globe over the past few months is reinforced by our Q2 TPP tracker analysis. The number of TPPs across the EEA increased by over 29% between 31st March 2020 and 30th June 2020 with 82 new TPPs being approved for services. This is significantly higher than the growth recorded in the previous quarter.

The Konsentus Q2 tracker looks back at the last quarter but, where it differs from before, is that we also now include some projections on what the numbers might look like at the end of September 2020 – one year on from the implementation of PSD2 Open Banking.

Highlights Q2

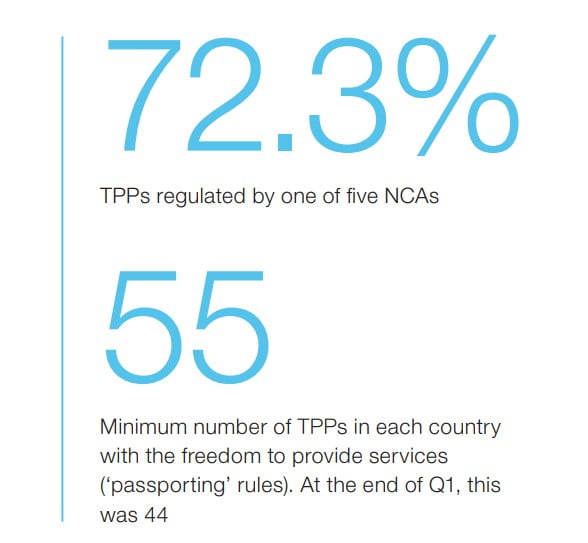

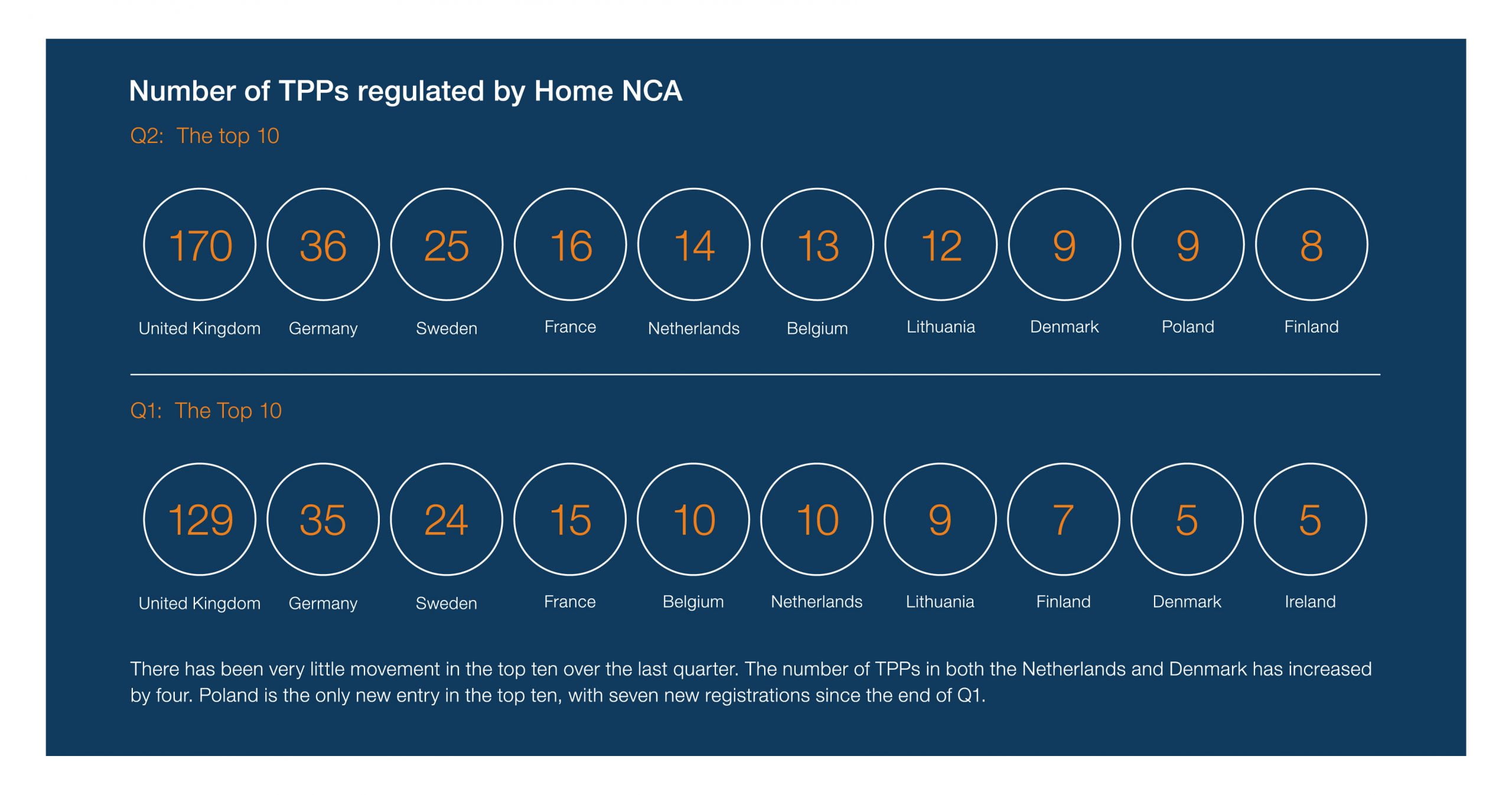

• A total of 361 TPPs are approved to provide services across the EEA

• Italy and Spain have both seen TPP numbers more than double over the last quarter

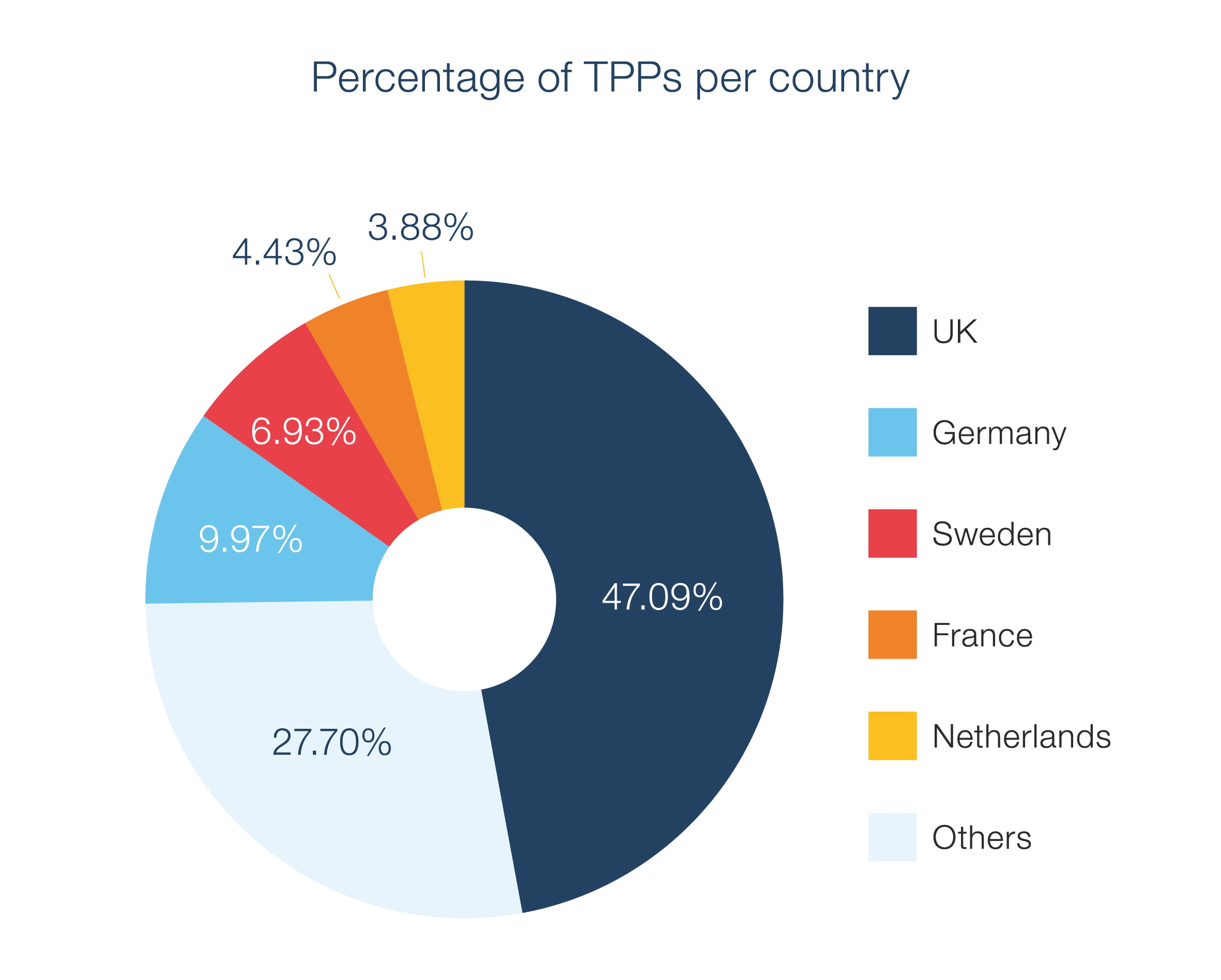

• Over 47% of TPPs are regulated by the FCA, the Home NCA in the UK

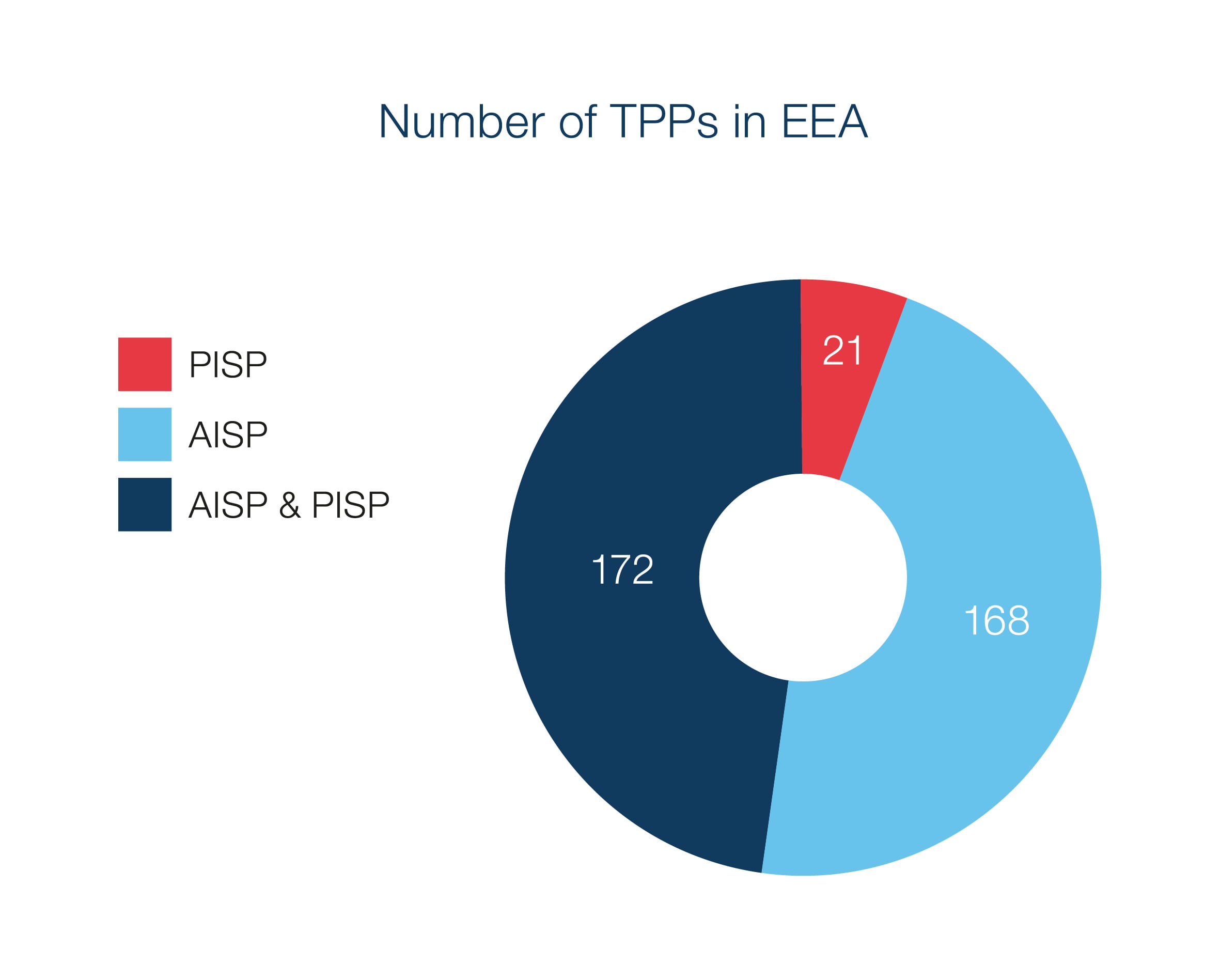

• 94% of TPPs are registered either as an AISP or AISP & PISP. Only 21 of the 361 TPPs are registered as a PISP only

• Greece, Iceland, Liechtenstein and Slovakia now each have a TPP regulated by their home NCA, leaving only 4 countries in the EEA with no home approved TPPs

• 29% increase in TPP approvals from Q1 to Q2

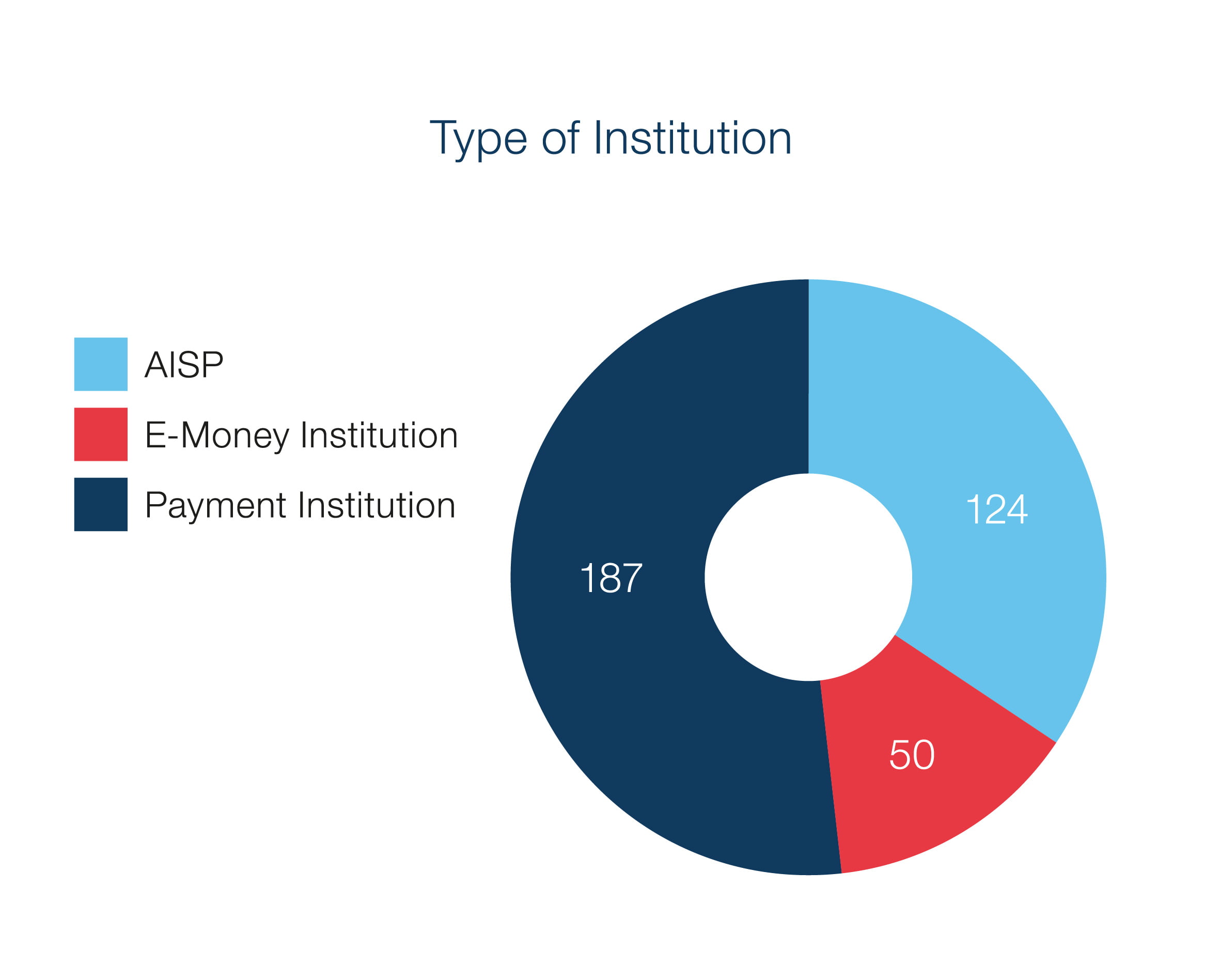

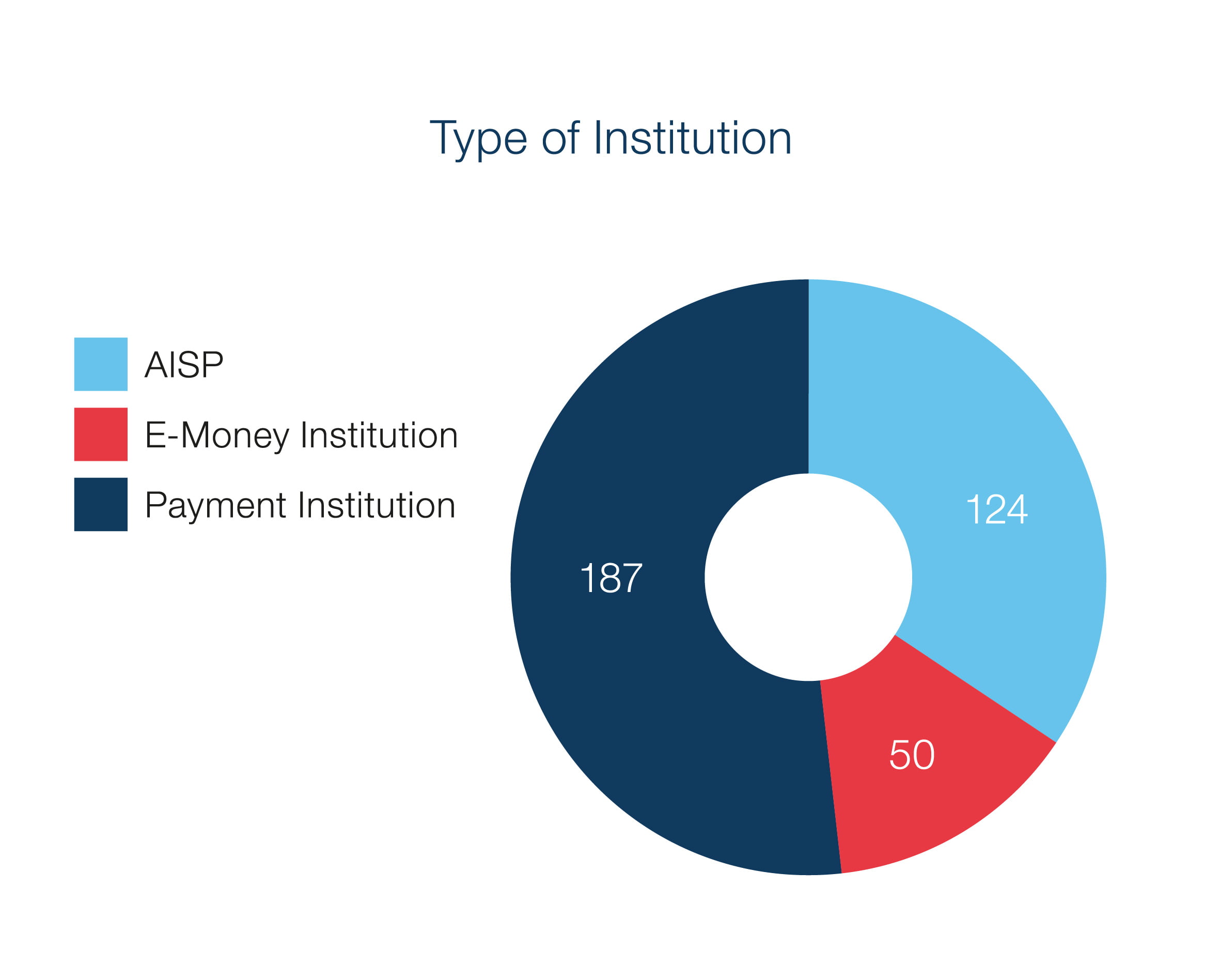

As we saw last quarter, 94% of TPPs are registered to provide account information services and just over 50% of those registered are Payment Institutions*

*‘Payment Institution’ means a legal person that has been granted authorisation to provide and execute payment services which are not connected to taking deposits or issuing electronic money.

Note: these figures do not include Credit Institutions acting as TPPs or CBPIIs

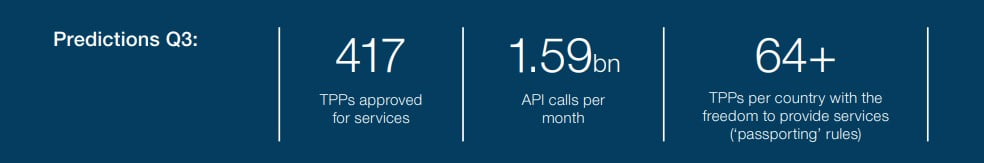

Projections for Q3 2020

Projected Q3 TPPs across the EEA

Looking back over historic data and growth trends, we expect the

number of TPPs to reach 417 by the end of September 2020. This

is more than double the number of TPPs that were approved

when PSD2 Open Banking was implemented in September 2019.

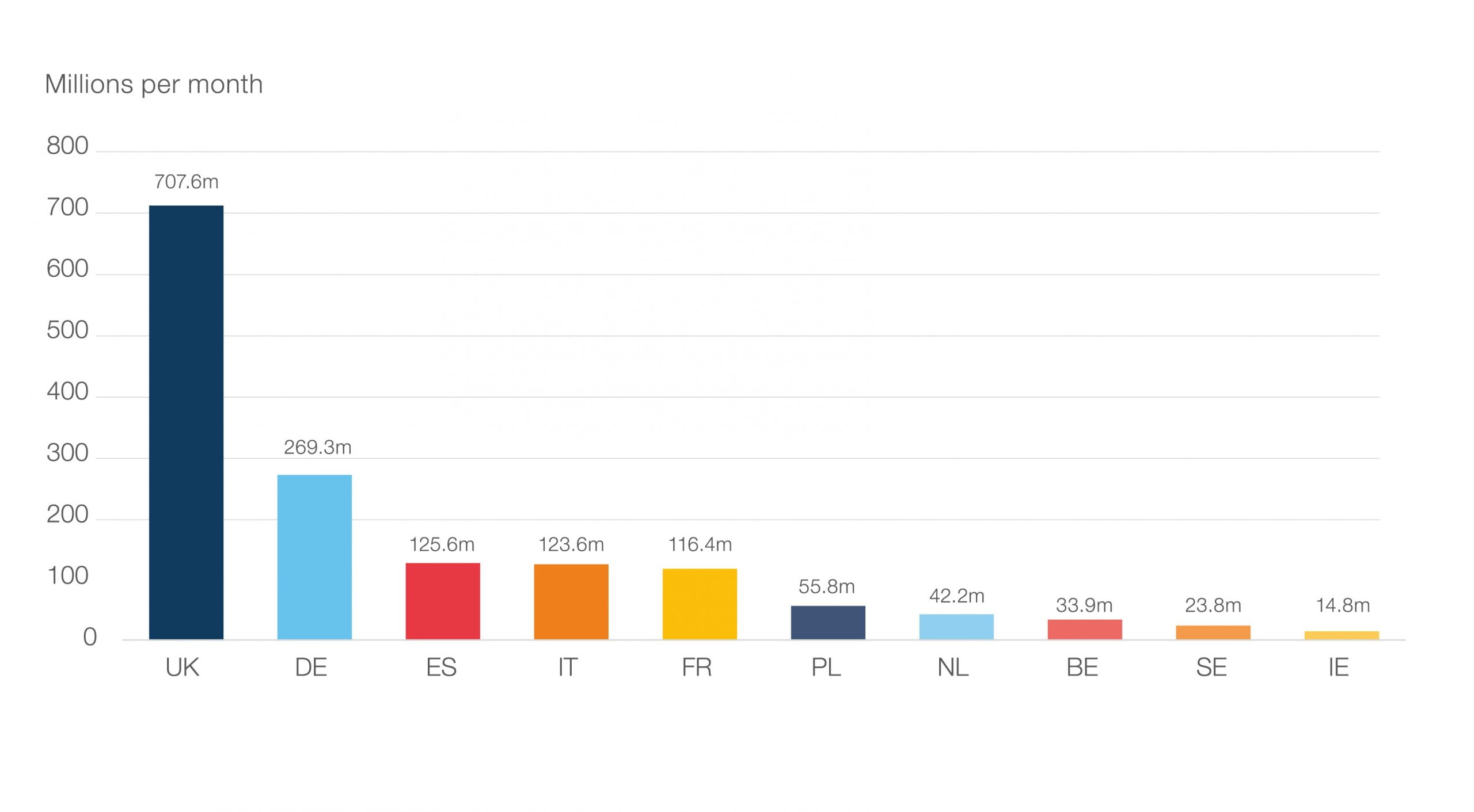

Projected Q3 PSD2 Open Banking API calls across the EEA

We expect a total of 1.59bn API calls to be made across the EEA each month by the end of September 2020. The UK API volume is expected to reach 707m

monthly (based on AISP calls only, however we expect this number to increase substantially once PISP services are launched in the UK market). Germany 269.3m and Spain 125.6m.

By September 2020, 18 out of 31 countries (58%) should be anticipating in excess of 5m API calls per month.

We expect 11 countries to be receiving over 10m API calls per month

“The move towards a digital economy could not be more evident than this quarter with 82 new TPPs being approved for services. We expect this growth trend to continue into Q3 when the number of TPPs across the EEA is expected to reach 417. This shows that PSD2 Open Banking is supporting a thriving appetite for new products and services.” Mike Woods (CEO, Konsentus)

Latest Articles

International Women’s Day 2021

International Women's Day 2021 To celebrate International Women's Day 2021, Barclays would like to invite you to join a series of panel discussions to be held virtually on: Monday, 8 March - 8:30am - 9:30 am EST / 1:30pm - 2:30pm GMT Thursday, 11 March - 4:00pm -...

Fintech investment builds on momentum and is set for record year

Fintech is continuing to enjoy popularity with investors who see it as a sector with excellent prospects for sustainable growth. The sector’s rise last year against a backdrop of great uncertainty has continued in 2021, with strong investment volumes gaining momentum....

Singapore Fintech Festival 2019

Singapore FinTech Festival 2019 summary of activities from the Fintech Power 50: Singapore FinTech Festival 2019 has proved another resounding success. Inaugural SFF x SWITCH sees over 60,000 participants from 140 countries; event to return on 9-13 November 2020....